What company or industry do you want us to cover?

We want to create a community of investors, make sure to subscribe and share!

Investment Thesis:

As commerce moves online, businesses need to anticipate changing customer expectations and deliver engaging and personalized experiences across all channels. Additionally, the entire shopping journey is transitioning, including desktop to mobile, more responsive applications, and the in-venue experience. In the digital age, businesses need a platform like BigCommerce for cross-channel commerce that nimbly keeps them at the forefront of user experience and innovation.

Company Description:

BigCommerce Holdings, Inc. provides technology services. Its software-as-a-service platform powers its customers branded e-commerce stores and their cross-channel connections to online marketplaces, social networks, and offline point-of-sale (POS) systems.

Qualitative

Overview:

Sector: Technology

Industry: Software – Application

Competitors: SHOP,

Strategy: Partner Centric

Core Products Focus – Strive to create the industry’s best eCommerce platform and innovate faster than competitors by focusing on developing a single core product.

Best-of-breed Choice – tightly integrated solutions across verticals.

Cooperative marketing & sales – BIGC co-markets and co-sells with their strategic technology partners in each category.

High gross margins – BIGC earns a high-margin revenue share from a subset of their strategic partners which compliments the high gross margins of their core eCommerce platform.

Business Model: Ignite Growth, Not Complexity

Flexible open SaaS platform leading a new era of ecommerce

Provide a comprehensive platform for launching and scaling an ecommerce operation including store design, catalog management, hosting, checkout, order management, reporting, shipping, accounting, and API management.

Power both customers banded ecommerce stores and their cross-channel connections to marketplaces, social networks, and offline point-of-sale.

Market: SMBs, mid-markets, and large enterprises

As of September 30, 2020, BigCommerce has ~60,000 stores in ~150 countries

According to eMarketer, ecommerce is expected to grow to 21% of all global retail spending in 2023.

Global retail ecommerce is expected to reach $3.9T in 2020 and is forecasted to reach $6.3T in 2024 (eMarketer).

Differentiation: Open SaaS Platform

BIGC believes their platform openness is industry-leading for SaaS, spanning every part of the ecommerce retail business.

BIGC’s open SaaS, as a strategy, competes with the flexibility of legacy software and can scale up to 400 API calls per second per customer.

BIGC customers benefit from a platform that seamlessly progresses its capabilities and performance regularly allowing customers to save money and stay ahead of industry trends.

X-Factor: Earn revenue share and customer referrals from our extensive partner ecosystem

BIGC’s strategy is to partner – not compete – within their ecosystem.

Many strategic technology partners pay BIGC a revenue share on their gross sales on their joint customers and/or collaborate to co-sell/market BIGC to new and existing customers.

BIGC plans to grow partner-sourced revenue by expanding the value and scope of existing partnerships.

Cash Cow: Enterprise Plans

Higher LTV and stronger retention

Subscription services make up 67.5% ($27M of $40M) of total revenue and enterprise plans make up 54% of total subscription revenue.

“Internet Retailer states that SaaS has now become the top choice of the largest U.S. retail ecommerce sites planning to re-platform, and we are aggressively positioning ourselves as the best SaaS solution for this segment.”

Growth Opportunities:

Retain & grow with existing customers through product and service leadership

Acquire new mid-market and large enterprise customers

Acquire new SMB customers

Expanding into new & emerging segments; headless commerce, B2B, & large enterprises

Expand internationally

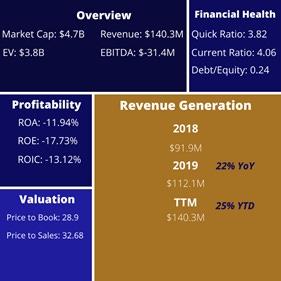

Quantitative

Risks

BIGC is not yet profitable.

BIGC is a new publicly traded growth stock and is subject to increased volatility compared to more established competitors.

Sales cycles with mid-market & large enterprises can be long and unpredictable.

BIGC operates in a very competitive industry.

Learn Something

Company Materials: 10-Q | Q3 Presentation | Investor Relations | S-1

Digital.com: “BigCommerce Review – 10 Reasons Why You Should (or Shouldn’t) Trust Their E-Commerce Software”

nchannel: Advantages & Disadvantages of SaaS eCommerce Platforms

Futures: Futures are derivative financial contracts that obligate the parties to transact an asset at a predetermined future date and price.