What company or industry do you want us to cover?

We want to create a community of investors, make sure to subscribe and share!

Investment Thesis

There has been a material shift in consumer preference when discussing fast, casual food. This material shift has been towards healthier, albeit, more expensive options. Chipotle was at the forefront of that change, branding itself as a healthy quick choice. Being at the forefront and at the technological cutting edge gives this business a lot to like.

Company Description

Chipotle is a quick-service restaurant (QSR) specializing in Mexican food. Its menu includes burritos, bowls, tacos, and salads, which are made from higher-quality ingredients than those typically found at quick-service restaurants. They own restaurants in the United States, Canada, the United Kingdom, France, and Germany.

Qualitative

Overview

Sector: Consumer Cyclical

Industry: Restaurants

Competitors: Chick-fil-a, McDonalds, Qdoba

Strategy: Use Better Ingredients

Chipotle’s mission statement is to provide “Food with Integrity”

Source their food in sustainably raised farms, farms can not use antibiotics or added hormones with their meat

Their website lists every single ingredient they use in their menu, furthering their strategy to cater to health-conscious consumers

Business Model: High Churn

Chipotle being one of the biggest QSR restaurants was a self-fulfilling prophecy

Since they focus on fresh locally sourced ingredients, the higher the churn, the fresher the meals will be

Fresh meals get their customers in the door, thus completing the self-fulfilling prophecy of their chain empire

Market: Health Conscious – Younger Generation

41% of Generation Z and 32% of Millennials would “pay a premium for sustainably sourced ingredients”. (2019).

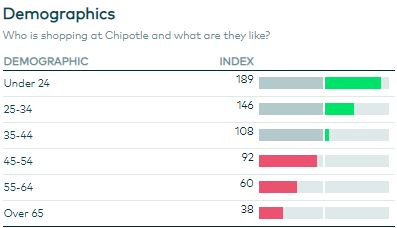

The demographics chart below is a scale where 100 is average, or in line with the industry

Chipotle has a whopping 89% more under-24 demographic and 45% more mid-20s-mid 30s demographic

Chipotle has massively positioned itself as a “Millennial and Younger” company, they are targeting the younger generation to be life-long customers and are succeeding

Moat: Brand Image & Loyalty

Constantly reinforcing their commitment to quality, produces more brand loyalty

Chipotle rarely adds new food to their menu but when it does their customers generally know it will be of quality

Apart from their nationwide 2017 Queso launch, each new item has been met with positive reviews

Chipotle was a pioneer in the assembly line type fast-casual restaurant chain

Brining offspring competitors in other cuisines being the “Chipotle of (Insert Cruise Here)”

X-Factor: Digital Sales

Digital sales exploded in the most recent quarter, with a 202% YoY increase

Digital sales accounted for 49% of revenue

These digital orders increased same-store sales growth by 8.3% when compared to Q3 2019

Digital Sales are so powerful because these get their customers on their mobile app, giving data and familiarity to customers

Their app is sleek, shareable (friends can add to order through text), and customizable

Application download will give customers notifications of promotions, new items, and order history for an easy ordering experience

Cash Cow: Pricing Power

When they released the second generation of Carne Asada, they increased its cost by $.25 and saw no “degradation” in demand “at all”

This pricing power is directly correlated to their brand of “Food with Integrity”

Customers are willing to pay a premium for quality ingredients and understand quality comes at a price

For years, Chipotle has been steadily raising pricing with a projected 4.5% increase in 2019

In 2019 their total revenue increase was 15%, proving that small increases are not driving customers away

Growth Opportunities: Chipotlanes

This growth opportunity is a piggy-back off their digital sales increase

As mentioned, their digital sales were HALF of the total revenue for Q3 2020 (July- September)

Their new store design includes a drive-through lane only open for mobile order pick up, which includes delivery drivers

This drive-through lane also includes a second assembly line, essentially doubling their available space to create their meals

This business shift can not understated, forcing customers to their digital ecosystem while doubling their ability for sales will prove worthwhile

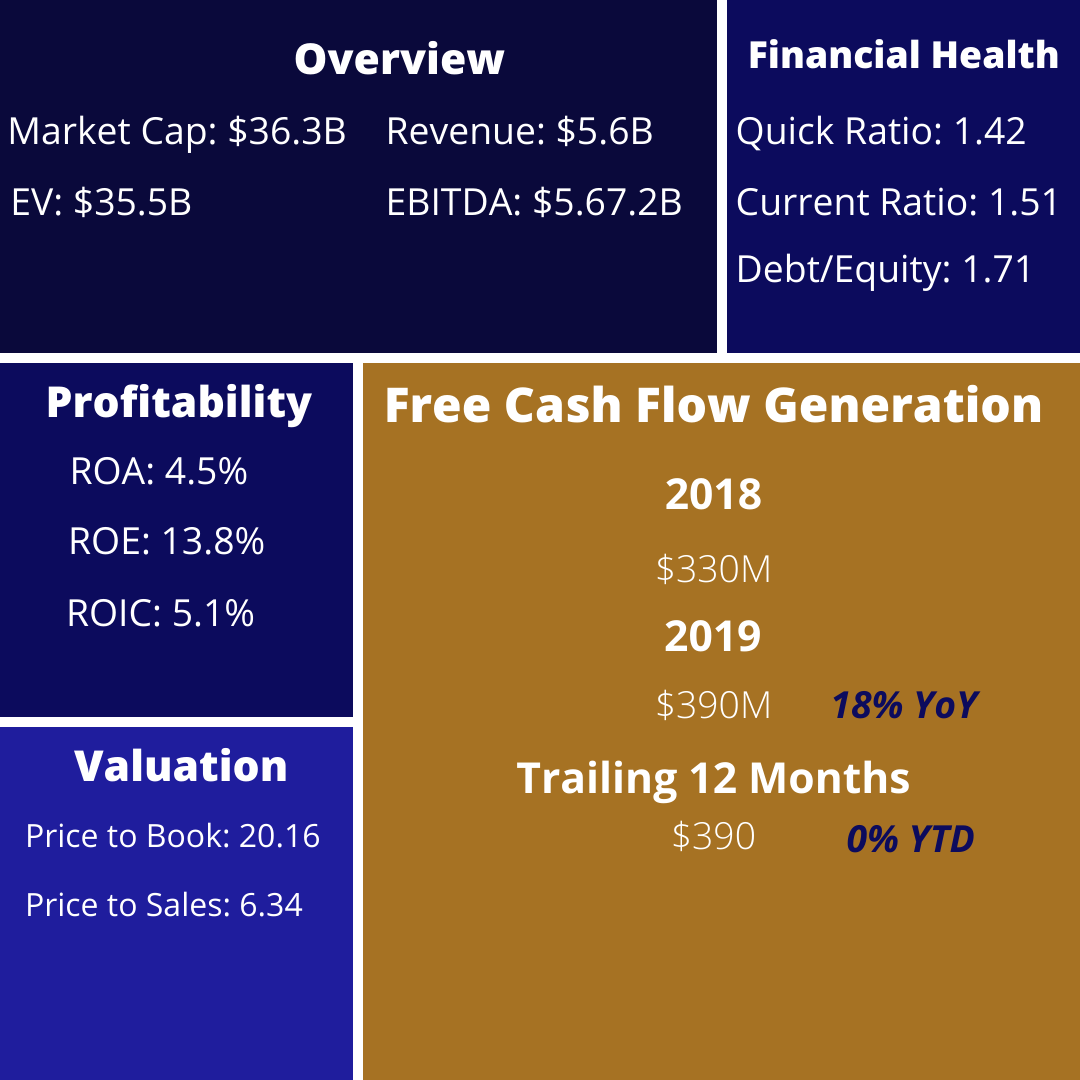

Quantitative

Risks

Their brand of superior ingredients is subject to risk in supplier’s prices that could drive margins down in the long term

The new roll-out of Chipotlanes is capital intensive, if this rollout fails it will dig a deep hole in their balance sheet

Food safety continues to be a lingering concern after their widespread salmonella outbreak in 2015

Quick Service restaurants are continuing to grow, placing more competition against Chipotle

Learn Something