What company or industry do you want us to cover?

We want to create a community of investors, make sure to subscribe and share!

Investment Thesis

Bullish on data collection, data management, cloud storage/computing, and data visualization. Cloudera’s cloud platform and open source software creates a comprehensive enterprise solution that allows customers to get the most out of all of their data.

Company Description

A software company that develops platforms for data management, machine learning, and advanced analytics. The company's platform addresses three new transformative markets, Dynamic Data Management Systems, Cognitive/AI Systems and Content Analytics Software, and Advanced and Predictive Analytics Software.

Qualitative

Overview

Sector: Technology

Industry: Software Application

Competitors: AMZN, MSFT, Snowflake

Strategy: Empower customers to drive insights from complex data in any data center or cloud and to manage & secure the data lifecycle.

Deliver the enterprise data cloud

Grow their addressable market by expanding multi-function analytic offerings and range of use cases the platform can support.

Accelerate existing customer expansion by cross-selling products and helping existing customers adopt CDP.

Extend position as an open-source leader for data management and analytics.

Business Model: Software Subscriptions & Cloud Services

Market: Large corporate enterprises and public sector organizations globally

Cloudera has approximately 1,900 customers.

No individual customer represents more than 10% of revenue.

Differentiation: Enterprise Data Cloud

Enables customers to manage and secure the complete data lifecycle from Edge to AI.

Hybrid & multi-cloud deployments at scale mixing on-premise and public cloud infrastructure including AWS, Azure, GCP, and IBM.

Enterprise-grade data security and governance.

Cloud-native, scalable, and open-source – enables scalability and connectivity.

X-Factor: 100% Open-Source

100% open-source software licensing policy aimed at attracting customers and integrating with all of their client’s data and cloud needs.

Enriches network effects and utility.

Open source characteristics enable fewer barriers of entry and could increase competition.

Cash Cow: CDP SaaS

Revenue of $667,826, 84% of total revenue.

Cloudera SDX (security), Control Panel, Runtime, and support infrastructure.

CDP Data Center, Data Hub, Warehouse, and Machine Learning for public clouds including AWS & Azure.

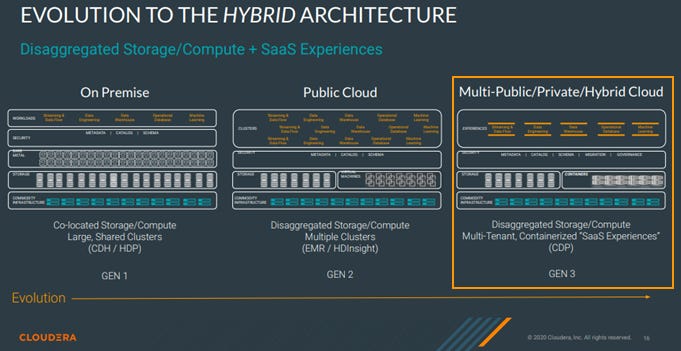

Growth Opportunities: Generation 3 Hybrid Architecture

Quantitative

Risks

Cloudera is not yet profitable.

Cloudera’s sales cycles can be long, unpredictable, and vary seasonally, particularly with respect to large subscriptions, and their sales efforts require considerable time.

Cloudera is a young company which affects their forecasting and pricing accuracy.

Learn Something

Company Materials: 10-K | Annual Meeting Presentation | Investor Relations

Fastmetrics: What is Cloud Computing & How Does it Work?

Enterprise Storage: How Does Cloud Storage Work?

Price-to-Sales (P/S): Valuation ratio that compares a company’s stock price to its revenues. A low ratio could imply the stock is undervalued while a ratio that is higher-than-average could indicate that the stock is overvalued.