What company or industry do you want us to cover?

We want to create a community of investors, make sure to subscribe and share!

Investment Thesis

Large corporations will continue to leverage cloud-based software analytics to make better decisions. We are bullish on the BSM space because it quite literally saves corporations money, something we believe corporations will continue to do. Coupa is the market leader in the BSM space and has terrific customer retention numbers, growing cash flows, and a great product.

Company Description

Coupa Software is a cloud-based business spending management platform that provides companies with increased visibility and control into how they spend money including; procurement, expense management, and invoicing.

Qualitative

Overview:

Sector: Technology

Industry: Software - Application

Competitors: ORCL, CRM, SAP

Strategy: Ensure Customer Success, Focus on Results, & Strive for Excellence

Deliver quantifiable business value to customers by maximizing spend management

Rapid time-to-deployment ranging from a few weeks to several months

Easy-to-use interface that reduces complexity leading to quick adaption helping generate value within a short timeframe, thus benefiting from rapid ROI

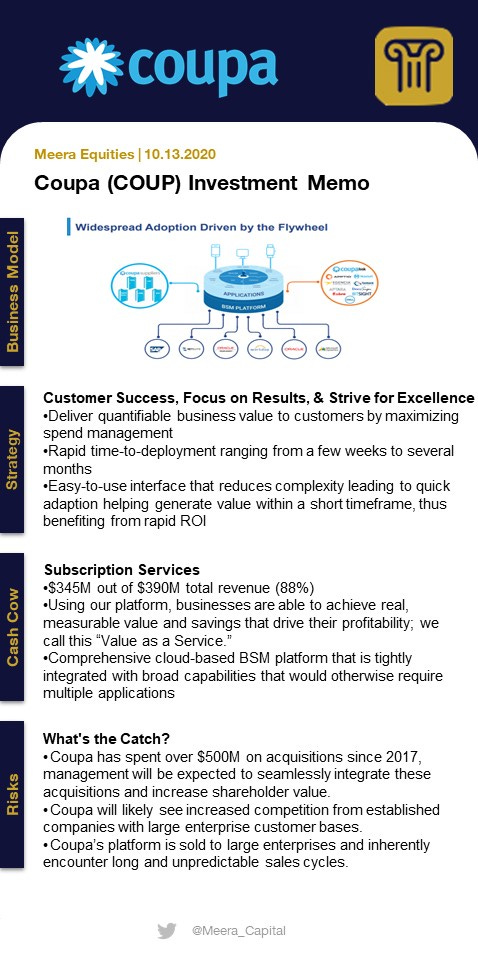

Business Model: BSM Platform

Drive Adaption in s short time - platform applies a distinctive user-centric approach that enables widespread adaption across the entire organization and supplier base.

Capture – transactional engine comprehensively helps capture and manage spend within an organization.

Analyze – real-time analytical and prescriptive insights help improve decision making

Control – manage and streamline spending activity that increases efficiencies and result in real savings

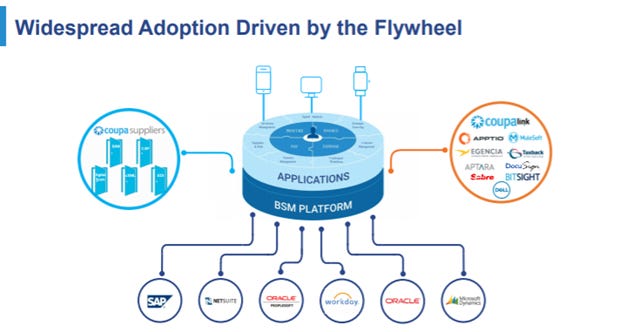

Market: Mid-Market & Enterprise Corporations

Coupa believes that the world’s largest 5,000 companies combine for over $13T in indirect spend

Moat: Network Effects & Customer Switching Costs

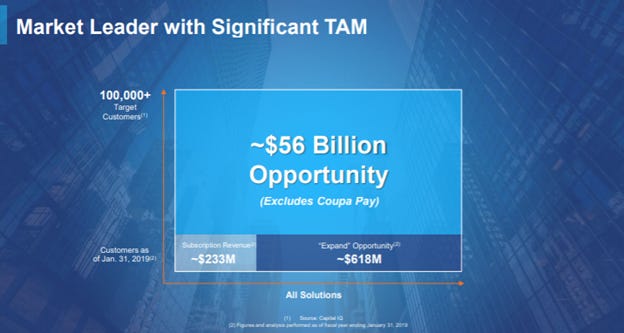

Over 80% of Coupa’s sales are influenced by partners

Coupa has added 2M suppliers with minimal friction

Very strong customer retention rates – Gross renewal rates over 95%, net retention over 112%, and customer spend on the platform has increased from $458M in 2016 to $1.2B in 2020

Customers unlikely to switch for cost savings considering Coup has helped customers save more than $8B in 2016 which has grown to over $40B in 2019

X-Factor: Coupa Open Business Network

Instantly connects business & suppliers through a portal that allows suppliers to manage content and settings on a customer-by-customer basis.

Actionable notifications (easily processes converts purchase orders and invoices) and direction connection vis cXML and EDI.

Companies become compliant with government mandates, increase profitability, reduce costs, and drive electronic transactions.

Cash Cow: Subscription Services

$345M out of $390M total revenue (88%)

Using our platform, businesses are able to achieve real, measurable value and savings that drive their profitability; we call this “Value as a Service.”

Comprehensive cloud-based BSM platform that is tightly integrated with broad capabilities that would otherwise require multiple applications

Growth Opportunities:

Expand international operations and develop a worldwide customer base.

Continue to establish strategic relationships with 3rd parties, implementation partners, system integrator partners, and technology providers.

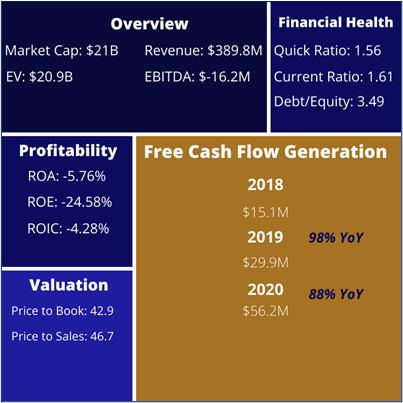

Quantitative

Risks

Coupa has spent over $500M on acquisitions since 2017, management will be expected to seamlessly integrate these acquisitions and increase shareholder value.

Coupa will likely see increased competition from established companies with large enterprise customer bases.

Coupa’s platform is sold to large enterprises and inherently encounters long and unpredictable sales cycles.

Learn Something

Company Materials: 10-K | Annual Meeting Presentation | Investor Relations

Coupa: Welcome to the Era of BSM - Business Spend Management

Purchase Control: What is Business Spend Management?

Cyclical Stock: Stock that's price is affected by macroeconomic or systematic changes in the overall economy.