Essence 06.08.2020

Discussion

Bloomberg Green – “BlackRock Joins Allianz, Invesco Saying ESG Outperformed”

TLDR; ESG investments are rising in popularity and returns. We believe ESG industries offers tremendous growth potential for investors. We anticipate an “ESG check” will become one of the most important criteria before making an investment.

"The rapid growth of ESG funds over the past five years -- more than $30 trillion of assets are now managed using a broad definition of the approach" -BlackRock

We believe the momentum in ESG investing is only going to get stronger.

Barriers of entry are crumbling in the finance industry. It has never been easier to access the public capital markets. Robinhood has done a tremendous job disrupting retail trading. The days of zero commission equity trades are still fairly new. Giants like Charles Schwab, TD Ameritrade, and Fidelity didn't join the race until 2019.

Fractional shares are the next domino to fall. Fractional share investing is starting to gain popularity and is currently offered by Robinhood, Charles Schwab, and Square to name a few. Unlike traditional stock buying, fractional investing is "dollar-based". Instead of buying whole units, investors decide on a dollar amount.

Additionally, the Millennial & Gen Z generations largely invest for impact. Impact investing refers to investments made into companies, funds, and organizations with the intention of generating beneficial social or environmental impact. According to RBC Advisor Services, "85 percent of Millennial investors are interested in impact investing." RBC also goes on to state "Unlike older generations who typically wait until later in life to donate to charitable causes, Millennials want to have an impact now."

As barriers to entry fall, individuals will be more empowered. We believe ESG investing will become a focal point with younger generations as they seek investments that are not only good for their portfolios but also meet their ethical requirements. Zero commission & fractional shares will make it easier to invest in ESG companies, funds, and strategies ultimately accelerating the trend. Companies will, in turn, go where the money is - i.e. adopt more ethical and mission-driven business practices.

Portfolio

Weekly Portfolio Checkup

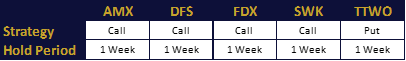

The week of 06.01.20 was our most successful week to date. We initiated 5 total trades, and profitability exited from 4 of them.

*To note, the total weekly gain is calculated using the market value of our PTON put we are currently holding. The market value of this position is .51.

Portfolio Overview

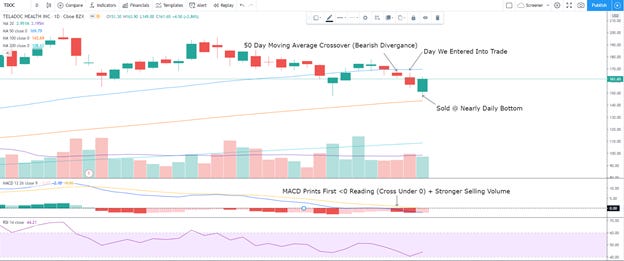

The previous week’s trades were initiated solely on Meera Capital’s technical indicator screener. The S&P 500 was up nearly 5% last week, but our analysis consists of strategies that play both sides of the market. Our biggest gain this week was a put-on TDOC (detailed explanation later).

Our strategy in this COVID-19 era is to take any gains that we are sitting on. Knowing that news can swing the market 5% in any given week, we elected to be liquid and as flexible as possible. Our longest-held position was FND. We held that position for 6 trading days, all other positions were traded within 2 days. Our philosophy is: Pigs Get Fat, Hogs Get Slaughtered.

The PNC call was bought ITM on 06/01 when it was trading at $114 and sold on 06/03 when it was trading around $119. PNC’s closing Friday price is $128, the option that we bought at $4.19 would have been worth $12.85, a hypothetical 200% gain. Did we make a mistake selling for only a 77% gain? We would argue no.

If we flipped the above example to look at our TDOC put, it would tell the exact opposite story. At market open on 06/04 we entered our puts when it was trading at $163 and sold at market open the next day at $151 for a 118% gain on our option. If we held on and hoped for 200%, our option closed at a price of $8.9 on Friday. This would bring our gains down to a measly 11%.

Nobody has ever regretted a 100% gain. The real thing to be concerned about is the opportunity cost of selling. With our high turnover on these options, turning 100% in 24 hours and redeploying capital where we see fit is extremely valuable. We are not looking for 1,000% returns on every one of our trades, we want our gains and we want to realize them. If you are trading these high-risk options nearing expirations, take your gains.

Weekly Trade Spotlight

This week, our trade spotlight is TDOC. A primarily technical indicator that we use is MACD. According to our screener, TDOC was a prime put candidate. Its price had been trending negative for nearly a month, but the general MACD direction was still showing a bull case. On 06/03, when we entered the trade, the trend had officially reversed. The first MACD reading to cross the 0 line, continuously higher selling volume, and lowering RSI support. That day, TDOC ended 4.5% lower, and the following pre-market reading was indicating a drop of another 3.5%. Referring to our strategy, we sold immediately at market open.

Week Review

Watchlist 06.01.2020

Watchlist 06.08.2020

Analysis

Industry Spotlight

This month’s industry spotlight is the previous month’s best-performing industry, the airlines. The airline industry is up 53% over the previous month, with a majority of those gains coming this past week.

The S&P 500 is only down 1.1% YTD due to its stellar run since the mid-March bottom. But the airlines tell a completely different and justifiable story.

As you can see in the above graph, these companies have faced unprecedented challenges in 2020 with travel coming to an almost complete halt. The ETF $JETS is comprised of all US airlines, their top 4 holdings (American Airlines, Southwest, United Airlines, Delta Air, and Sky) have a combined market cap of $54 Billion. In December 2019, their combined market cap was $81 Billion. Pre-Pandemic, Delta was the biggest of the 4, but now Southwest has taken the crown. They have been the “best performer” in 2020 and is only down 29% YTD.

So, looking at the chart above and the combined -32% wiped out from these companies, are they all a steal at these prices? The answer depends on your time horizon.

Southwest Airlines Spotlight

One of Southwest’s greatest strengths is its balance sheet. All airlines are expecting at the minimum an 85% YoY drop in their Q2 revenue, so having cash on your balance sheet is especially important. Other giants like United and Delta are cash poor which has resulted in increased expense cutting measures, potentially limiting future growth. Additionally, this has changed their capital structure as they have almost 2x debt than they do in retained earnings.

While we believe most of the major airlines will not fail and go bankrupt, a government bailout or bankruptcy filing could make these companies look very different in the future. When looking at the industry, we believe the following;

Short term

Air travel will be slow to recover

Airlines will face challenges keeping customers safe while adhering to pre-COVID-19 cash flow and efficiency drivers (i.e. leaving the middle seat open)

Airlines will offer fewer routes especially internationally

Long term

Widespread distribution of a vaccine will restore consumer confidence in travel

Business travel will decline with the increased use of internet communication tools

With those bullet points above taken into consideration, why is Southwest managed better than the rest? First of all, consumers love Southwest. Their brand loyalty is off the charts compared to their “corporatized” competitors. The fact of the matter is, they put the customer first. The biggest example of this is their $0 baggage fees.

Second, Southwest has an economic moat, specifically the way they operate. They fly the 737 exclusively, lower their costs by only including point to point (no layovers, direct city to city), and lead the industry in employee productivity.

Third, they have a pre-existing market share. In this post-COVID era of operations, cost-cutting will be king. That has been Southwest’s strategy since its inception. They control 24% of the US domestic travel market and serve 11 countries. Their footprint in travel is written in sharpie.

If you are looking for a buy and hold on a long-time horizon, Southwest looks to be the best of the bunch.

Private Company Spotlight

Rise Gardens: Website | Funding

Rise Gardens is an indoor hydroponic gardening system designed to help the consumer seamlessly grow fresh produce in their homes. The company is based out of Chicago, IL and recently raised $2.6M in seed funding.

Rise Gardens combines both hardware and software into the consumer experience. The gardening kit is about the size (and look) of a bookshelf and can be set up in around 45 minutes. The kit uses hydroponics to grow plants taking advantage of nutrients and water instead of soil and sunlight. The company’s software tracks how much users should water their plants while also providing notifications, light scheduling, customized guidance, e-commerce, and more.

In an interview with Tech Crunch CEO Hank Adams said that “sales have increased 750% and Rise has sold 6,000 seeds per week in the last two months, which represents more than 1,500 pounds of produce.” Although there is a lot of competition in the vertical farming space, Rise Gardens is one of the few companies to focus on a direct to consumer model. “Our system was built to grow a volume of food,” says Adams who also claims in only takes between 22-25 days to grow a full head of lettuce using their kit. Users can seamlessly order more seeds and different produce on the company’s website or even set recurring orders.

Adams hopes Rise Gardens will follow the path of home appliances that were once considered a luxury like dishwashers that we can’t see ourselves living without today. I believe Rise Gardens has the ability to capture even more market share as consumers become more focused on nutrition and where their food comes from.

Doodle

To take the spotlight away from investing, we want to bring up a national and global issue. Racism.

There needs to be a bottom-up approach to solve this issue. What has happened and is continuing to happen is disgusting & unacceptable.

Take action, stand with those who have historically not been able to stand alone. All lives don’t matter until black lives matter.

Please consider a donation: 115 Ways to Donate in Support of Black Lives and Communities of Color

Learn Something

Fractional Shares Resources

Definition: Less than one full share of equity is called a fractional share. https://www.investopedia.com/terms/f/fractionalshare.asp

Blog: https://www.fool.com/investing/2020/05/25/fractional-shares-why-its-in-the-news.aspx

Deep Dive: https://www.m1finance.com/blog/truth-about-fractional-shares/

Blog: https://www.fool.com/the-ascent/buying-stocks/best-fractional-equity-shares/

Brokers: https://www.thebalance.com/best-brokerages-for-fractional-share-investing-4173377

Options

In the Money (ITM): An expression that refers to an option that possesses intrinsic value. https://www.investopedia.com/terms/i/inthemoney.asp

Out of the Money (OTM): An expression used to describe an option contract that only contains the intrinsic value. https://www.investopedia.com/terms/o/outofthemoney.asp

Opportunity Cost: Represents the benefits an individual, investor or business misses out on when choosing one alternative over another. https://www.investopedia.com/terms/o/opportunitycost.asp

MACD: Is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. https://www.investopedia.com/terms/m/macd.asp

RSI: A momentum indicator that measures the recent price changes in the stock to determine it is overbought or oversold. https://www.investopedia.com/terms/r/rsi.asp

Southwest’s Future Success Resources

10 Biggest Airlines: https://www.fool.com/investing/the-10-biggest-airline-stocks.aspx

Morningstar Analysis: https://www.morningstar.com/stocks/xnys/luv/quote

Brand Loyalty: https://www.brandextract.com/Insights/Podcast-Episodes/Brand-Analysis-Southwest-Airlines/ or https://www.thrillist.com/travel/nation/southwest-airlines-customer-loyalty

Continuous Improvement

Tell us how we are doing! We always appreciate feedback and want to do our best to connect with our readers.

Please take our survey: https://docs.google.com/forms/d/e/1FAIpQLScngneDBiiGoISePVr4irhxu9r01pB6U05D8N9DAeTEVCclRQ/viewform