What company or industry do you want us to cover?

We want to create a community of investors, make sure to subscribe and share!

Investment Thesis

We are very bullish on the long-term trend and possibilities of the gig economy. We believe Fiverr is a market leader in the gig space deploying a unique and scalable services-as-a-product (SaaP) that adds value for both the buyer and seller.

Company Description

Fiverr is a marketplace involved in buying and selling digital services in the same fashion as physical goods on an e-commerce platform. The platform is built with a comprehensive SKU-like services catalog, search, and orders mirroring a typical e-commerce transaction.

Qualitative

Overview:

Sector: Communication Services

Industry: Internet Content & Information

Competitors: Upwork, Guru, Freelancer, Toptal

Strategy: Change how the world works together

Bottom-up approach - targets individuals and teams who work in various business functions at companies of different sizes across different industries.

Reduce friction - the traditional freelance process has been disconnected with very little consistency from person to person.

No sales force – aim to acquire new buyers through the most efficient channels with the highest ROI by providing exceptional value and experiences for their buyers.

Business Model: Marketplace

Their business model involves connecting buyers and freelancers that contract directly through the Fiverr platform.

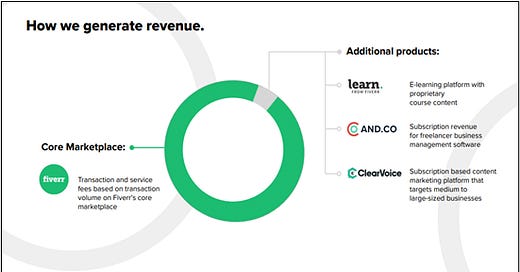

Fiverr derives a majority of its revenue from transaction fees and services feels that are based on the total value of transactions ordered through the platform.

The target audience is SMBs where high-value creation is experienced on the first transaction which leads to high LTV and cross-category purchases.

Market: Freelancers

Traditional Workplace; Long-term employment, work from an office, local teams, work offline, stability, work full-time, receive a monthly salary.

Future of Work; Experience building & freelancing, work from anywhere, global & remote teams, work digitally, leveraging collaboration tools, fulfillment.

$100B Addressable market, $750B+ estimated US total freelancer income.

Moat/Differentiation: 2-sided marketplace & powerful flywheels

Their business model can rapidly scale and as it grows, Fiverr benefits from a growing network effect.

More buyers attract more sellers, which, in turn, leads to more selection, better value for your money, increased engagement, and spend by buyers.

E-commerce approach to freelancing; service-as-a product, on-demand, end-to-end platform, and a global community.

X-Factor: Growth of Gig economy

Freelancing is still an old-school business and a majority of it still happens online.

36% of American adults engage in some sort of gig work and two-thirds of major companies are using freelance contracts to lower labor costs.

90% of freelancers think the industry will grow and if it keeps growing at its current rate, more than 505% of the US workforce will participate in it by 2027

Cash Cow: Repeat Buyers

Fiverr has consistent cohort behavior on the core marketplace with a majority of revenue from repeat buyers.

In 2019 existing buyers made up 58% of revenue.

Spend-per buyer has increased each of the last three years, growing from $119 in 2017 to $184 in 2020.

Growth Opportunities:

Innovate technology & services

Bring new buyers onto the platform

Move up-market for buyers & sellers

Expand Gig catalog

Expand geographic footprint

Quantitative

Risks

There is growing regulation in the gig economy which could materially and adversely affect the business.

If Fiverr fails to drive growth through organic channels the lack of a sales force could fail to hurt the company in the long-run.

Users may circumvent the platform and engage with or pay each other through other means to avoid transaction and user fees.

Learn Something

Company Materials: 10-K | Annual Meeting Presentation | Investor Relations

Forbes: 6 Trends that Will Shape the Gig Economy in the 2020s

Shengyu Chen: How to have a go-to-market organization at Scale (From A16z’s Mark Cranney)

Take Rate: The take rate refers to the number of users or site visitors that take action on an offer. It is also known as the visitor to lead conversion rate or the form completion rate.

Disclaimer: Meera Capital is not a registered investment, legal or tax advisor, or a broker/dealer. This article reflects the opinions of Meera Capital, this analysis is the basis for informational purposes only. The author of this article may have an interest in the security that is being discussed. Meera Capital encourages all readers to do their own research. This article was written with the intent of providing readers a basis to form their own opinion after reading our thorough analysis.