What company or industry do you want us to cover?

We want to create a community of investors, make sure to subscribe and share!

Investment Thesis

No industry is safe from innovation, no matter how established a product/service is. A recent incumbent disrupting an old-time industry is Lemonade, in the insurance industry. This company is a not-your-fathers-type insurance company. Lemonade has a strong presence and brand with the younger generations which is irreplaceable when considering lifelong product lines.

Company Description

Lemonade company offers a digital and artificial intelligence-based platform for various insurances and for settling claims and paying premiums. Their insurance offerings include renters, pet, and homeowners.

Qualitative

Overview

Sector: Financial Services

Industry: Insurance

Competitors: State Farm, Berkshire Hathaway, Farmers Insurance, Liberty Mutual.

Strategy: Re-branding the Insurance Industry

Insurance has long had a dark stigma and been an unappealing process to submit a claim or open a plan.

Lemonade is the new kid on the block, with a flashy name and a bright pink brand trying to immediately dismay this portrayal of the industry.

Everything is done online or from their mobile app. Need to open a policy? An AI bot will take care of it. Need to submit a claim? Take 2 minutes out of your day to log into your app and submit.

In addition to simplicity, it also has a focus on charity. Every customer who signs up picks a charity, and Lemonade takes 20% of that customer’s unclaimed premiums and donates to their charity of choice.

Business Model: Fixed Cost Pricing & AI

Transparency is in the DNA of Lemonade, they only offer a fixed price for all consumers.

Chatbots and machine learning are trending to become the primary way Lemonade handles signup and claims.

With the AI integration, they can settle one-third of claims within 3-4 seconds. This is because they can gather over 100x more data points than its competitors because of their chatbots.

In a late 2019 press release, Lemonade reported that 26% of all tickets were successfully handled by AI. This was posted 1 year ago today, so it is safe to assume that the ratio is steadily higher after looking at the chart below:

Market: Insurance – Renters, Pet, and Home

$5 Trillion is spent globally on property, casualty, and life insurance premiums per year.

Currently, they are not serving the life insurance industry, but that is subject to change as they expand their offerings.

The market is driven by older consumers as the need for more insurance products expands with age.

Moat: Conscious Capitalism

Lemonade’s brand is known for disrupting how insurance operates and its branding.

Their marketing towards their charitable donations from their profit makes the brand appeal stronger – eliminating the stigma around insurance as “The Necessary Evil”.

In a world of ESG investing, Lemonade is a prime example of an issue that is especially important to Millennials and eventually Gen Z.

Cerulli Associates (Third Party Research Firm) estimates that 54% of Millennial retail investors prefer ESG positive companies.

X-Factor: Young Consumer Base & Low Consumer Barriers to Entry

In Lemonades S-1 IPO filing, they outlined that 70% of customers are under the age of 35 and 90% claimed they did not switch from another carrier.

Their fixed price model makes insurance easy and affordable for first-time consumers.

This fixed cost model lowers the overhead of their business because they do not need physical locations or humans slowing down the process

Cash Cow: Loss Ratio Decline & “Land & Expand”

Loss ratio is an insurance ratio that takes total claims paid divided by customer premium paid. The lower the ratio, the better.

As Lemonade continues to grow, its loss ratio has decreased from 166% to 73% in Q4 2019.

In 2018 the industry average loss ratio was 71.4%, Lemonade is within striking distance of beating this benchmark ratio.

They attract customers on a “Land and Expand” approach. Get customers in at a fixed low rate, and slowly increase premiums in an attempt to steal market share.

In their Filing, customers that joined 3 years ago, now spend 56% more on their insurance with Lemonade.

Growth Opportunities: Product Offerings & Geographical Expansion

Currently, Lemonade only services the renters, homeowners, and pet insurance but this is only the start of their offerings

Young consumers, their primary demographic, do not necessarily need the greater umbrella policy and this is a huge growth opportunity.

Lemonade Wrote: “Our customers' lifecycle events trigger the need for additional insurance products that we expect to provide in the future”

Lemonade only operates in 41 states in the US and they are looking gain licensing in those states.

They also recently earned a European license that allows them to operate in 31 countries across Europe.

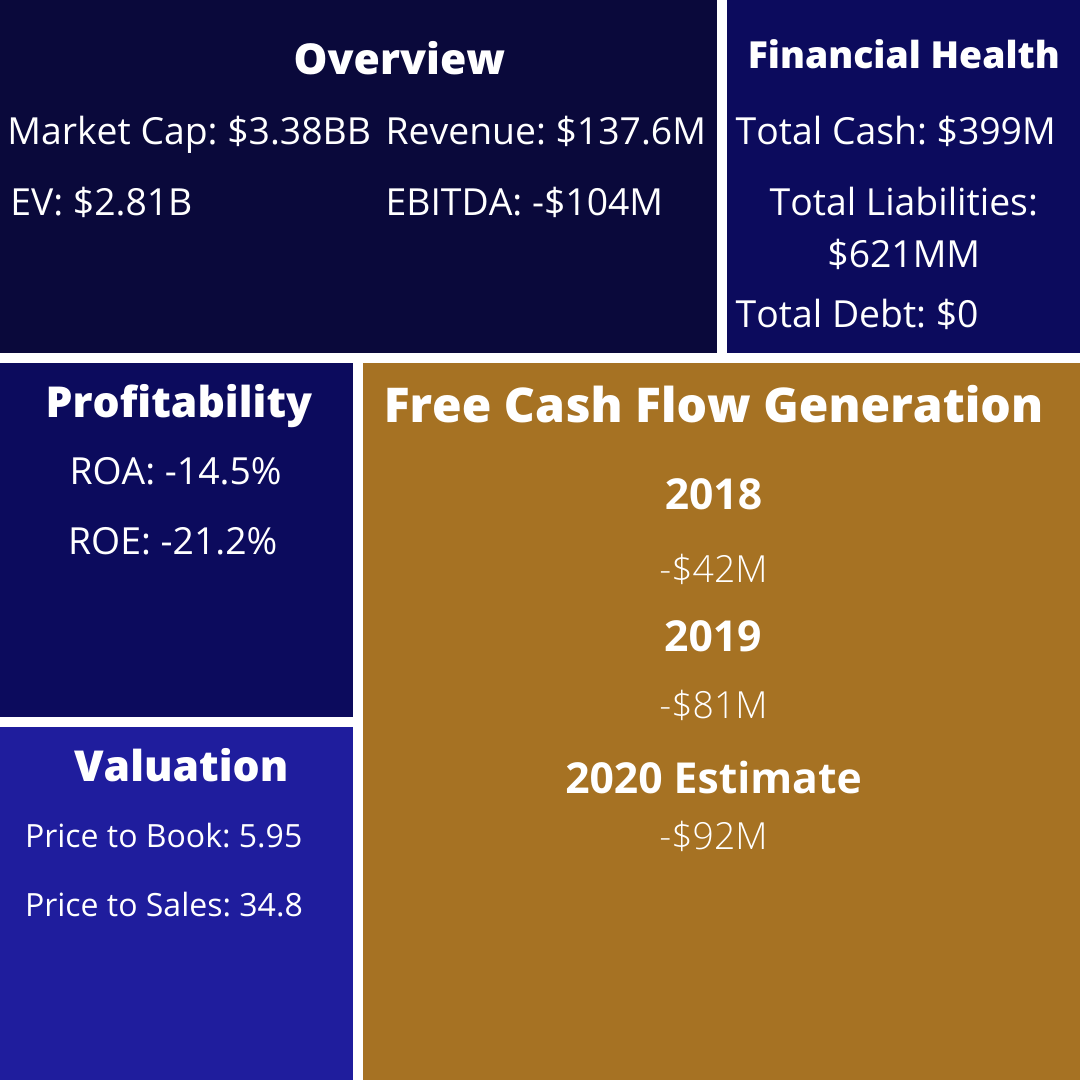

Quantitative

Risks

Have not recorded any earnings or positive free cash flow and will not very several years.

Donating 20% of unpaid premiums to charity will force a longer time horizon to profitability.

The company is only 4 years old and still very much in its adolescence unicorn stage.

At risk for similar start-ups and well-established brands launching digital-first brands.

Farmers Insurance has already launched a similar brand. These companies have established name recognition and trust with consumers.

Learn Something

Lemonade’s Detailed Growth Strategy: https://www.growthmanifesto.com/lemonade-growth-study#:~:text=Unlike%20other%20insurance%20companies%2C%20Lemonade,have%20a%20long%20road%20ahead.

$0 to $100 Million in 3 Years: https://www.lemonade.com/blog/zero-to-100/

S-1 IPO Breakdown: https://www.meritechcapital.com/blog/lemonade-ipo-s-1-breakdown

European Expansion: https://investor.lemonade.com/news-and-events/news/news-details/2020/France-is-Next-For-Lemonades-European-Expansion/default.aspx