Splunk (SPLK) Investment Memo

Meera Equities 10.6.2020

What company or industry do you want us to cover?

We want to create a community of investors, make sure to subscribe and share!

Investment Thesis

Big data has and will continue to be a growth catalyst for all major businesses and governments in the world. Everything is moving to the cloud and decisions are solely being made from data analysis, but the data must come from someone. That is where Splunk produces extreme value. If you are looking to make a blind bet on big-data, Splunk should be near the top of your list.

Company Description

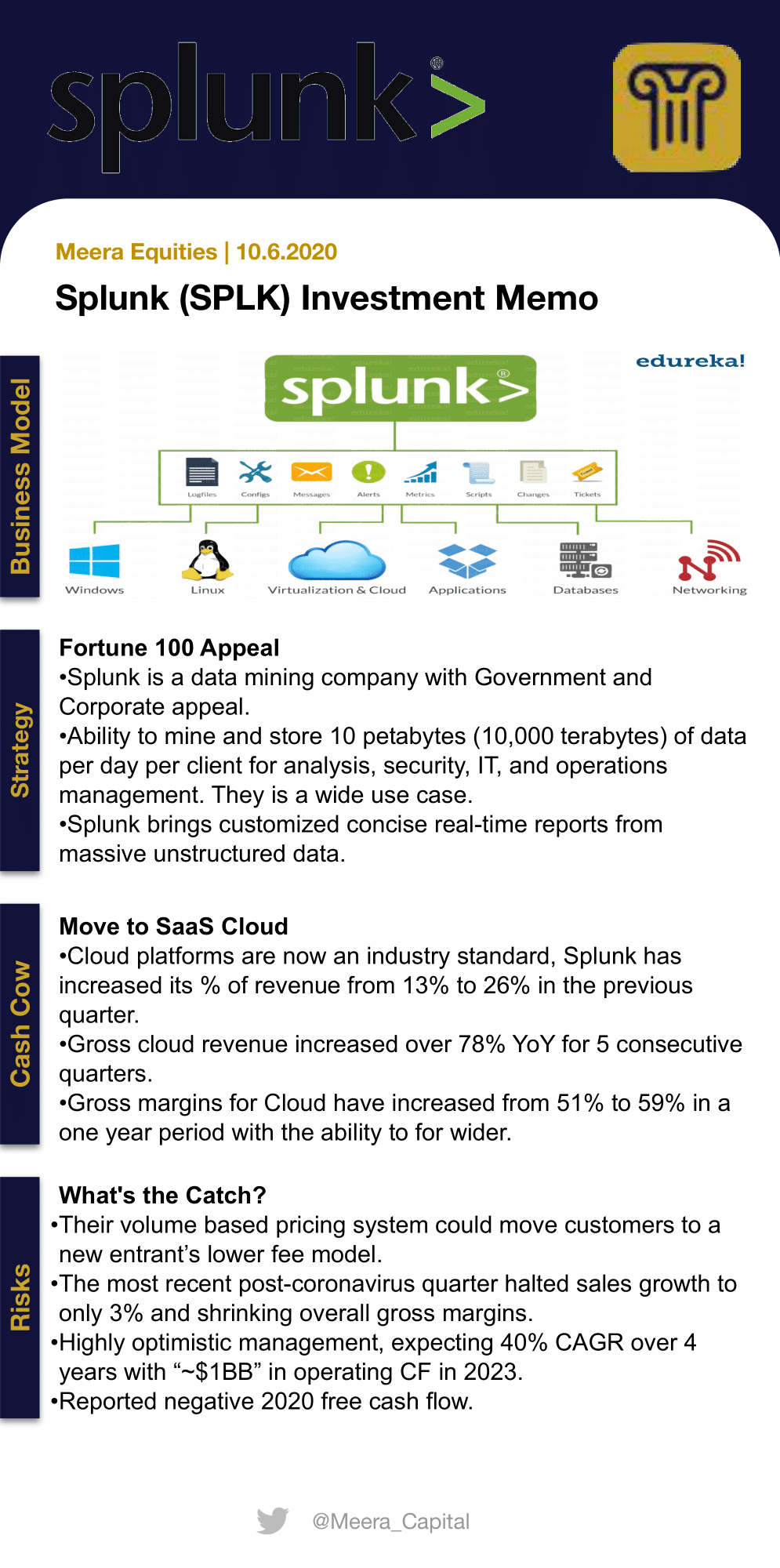

Splunk Inc. (Splunk) is engaged in the development and marketing of software solutions. The Company's offerings enable users to collect, index, search, explore, monitor, and analyze data. It’s flagship solution, Splunk Enterprise, is employed across a multitude of use cases including application management, IT operations, and security. The company has historically deployed its solutions on-premises, but the software-as-a-service delivery model is growing in popularity with Splunk Cloud.

Qualitative

Overview

Sector: Technology

Industry: Software - Infrastructure

Competitors: BMC Software, Micro Focus, IBM, Intel, VMWare, Microsoft

Business Model: Become the largest data mining, data storage, and third-party analytics company.

92 of the Fortune 100 companies use Splunk.

US Government uses Splunk to report census information.

Annual recurring revenue is $1.75 billion.

19,0000 total customers use Splunk.

30% of those companies are in the computer software industry, and 11% are in the Technology and Services industry.

Indicating their customers are also in the cutting edge industries poised for growth.

Market: Large Companies and Governments

Splunk is the leader in volume-based data mining.

The use case for large entities that have millions of data to pour through each day is wide.

Their data could be used for marketing, cybersecurity management, operational management, IT operations, and ticketing.

Moat: Data Mining Scale

Splunk can mine nearly endless data, every customer has the option to mine over 10 petabytes of data per day.

Using 10 petabytes of data would be equal to watching 25 consecutive years’ worth of 4K movies.

Splunk has built this moat by solely focusing on increasing data capacity while competitors have multiple other business segments.

X-Factor: Low Use Barriers and Stickiness of Platform

Splunk has put an emphasis on creating customizable intuitive reports for non-technology savvy clients.

This allows Splunk to be a contractor in replace of companies creating a new division to process and analyze data.

Splunk’s service centers allow customers to resolve issues/confusion without having to upgrade to a more expensive option.

Boasts >130% net dollar-based retention rates. Over 80% of license bookings are from existing customers.

Existing customer sales are extremely important because of their high concentration in the cash-rich Fortune 100 companies.

Businesses naturally have high switching costs. Costs include execution risk and the risk of losing data.

Cash Cow: Transition to Cloud Licensing and Cloud SaaS

Cloud platforms are now an industry standard, Splunk has increased its cloud revenue from 13% to 26% of total revenue in the previous quarter.

Gross cloud revenue increased over 78% YoY for 5 consecutive quarters.

AAR has increased by over 80% for 5 consecutive quarters.

Gross margins for Cloud have increased from 51% to 59% in a one year period with the ability to for wider.

Growth Opportunities: Globalization and Big Data Market

The Data Analytics market reached $171 billion in 2018, but industry estimates expect a $274 billion market in 2022 and $512 billion in 2026.

Splunk is the market leader in IT Operations Management with a 13% market share and the sub-industry expected to be worth $31.4 billion in 2025.

Globalization will a catalyst for Splunk after recently hiring an international sales manager who has 17 years of experience expanding Salesforce’s global SaaS segment.

Total global revenues are taking a larger scale of total revenue.

Quantitative

Risks

Their volume-based pricing system could move customers to a new entrant’s lower fee model.

The most recent post-coronavirus quarter halted sales growth to only 3% and shrinking overall gross margins.

Overly optimistic management, expecting 40% CAGR over the next 4 years with “~$1BB” in operating cash flow in 2023.

Reported negative 2020 free cash flow.

Learn Something

Splunk’s recent quarterly slideshow ith important growth figures: https://investors.splunk.com/static-files/f5a765ef-82cf-4ac0-a998-0f5966a5fd46

Splunk at the forefront for data analysis: https://investorplace.com/2020/08/big-datas-growth-will-clear-the-runway-for-splunk-stock/

Importance of data management: https://www.blue-pencil.ca/what-is-data-management-and-why-it-is-important/