Sports Bettors Driving Markets?

Discussion

Axios – “Sports bettors may be a driving force behind the stock market surge”

As an investor and sports fan, the growth of sports bettors and gamblers into equity markets has been tremendous. This may come to no surprise, but things are crazy right now. Sports betting has been surging in popularity, so without anything to bet on (casinos also closed), the stock market seemed like the next best option. Drawing a direct correlation between recent equity performance and no major live sports on T.V. is a fool’s game. That being said, let’s take a look.

Online brokerage platforms have seen a record number of new accounts. New accounts opened in Q1 respectively;

TD Ameritrade – 608,000

E*Trade - 363,000

Charles Schwab – 609,000

Robinhood – 3,000,000

Deutsche Bank has reported "plenty of evidence" that new retail investors have been buying since the stock market began to crash and that professional money managers are "now chasing" them.”

Dion has an amazing point – “Sports betting and stock trading aren't all that different.” That is by design. New and popular sports gambling services are built to mimic stock exchanges. Combine that with massive cultural forces like Wall St. Bets and Barstool Sports and the trend has accelerated.

Barriers of entry are falling, and they should, but what is the extent of change? Is this the new normal? What happens when sports come back on?

Unfortunately, there is no textbook for this stuff, just theories.

Our Takeaway:

1) There has been a massive influx of new investors in the stock market. Some of these accounts are going to stay, and they should. The stock market shouldn’t just be for the high net worth.

2) Such a dramatic shock to the system threatens traditional and previously “known” market practices. We are watching the 3 Vs; volume, volatility, and valuations.

Portfolio

Portfolio Overview

Coming into this week we were positioned strictly in bullish options, but we opened a few positions in puts with expiration in early July. So, these put positions are still in their infant phase. We opened positions in MTCH and LULU.

Unfortunately for us, all our bullish predictions did not pan out and they expired worthless. We bought all 4 calls on June 8th, which was the top in the S&P 500 in the post-COVID era. Our market sentiment has completely switched, we are bearish and have loaded up on puts. We bought OTM puts on LULU based on technical indicators and the incredible run they have had during 2020 and MTCH for similar reasons.

Weekly Trade Spotlight

We believe that LULU will drop significantly over the next few weeks. The MACD has a clean crossover and has seen lower highs and lower lows. Its pre-COVID all-time high is $266 that was reached in February and is currently trading at $297 with its new all-time high being $325 where that was reached two weeks ago. LULU did not have favorable earnings last week, but did have a positive bump from better than expected retail sales. But, the next trading day after earnings the MACD crossed over to bearish which confirmed the downtrend with us. On top of the indicators, AAPL announced that they are closing stores in certain states due to COVID. We believe this will have a greater fallout in the retail sector.

We have not sold these positions, but we plan on holding it until near expiration.

Week Review

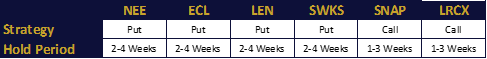

Watchlist 06.22.2020

Private Company Spotlight (Bold Italic)

Saturas is an Israeli based startup that has developed a decision support system for precision irrigation. Saturas has developed the “Stem Water Potential” (SWP) sensor that is embedded into trunks of trees, vines, and plants. The system provides information for optimized irrigation, essentially telling the farmer when it should be watered and how much water should be used.

See it in action: Saturas

Freshwater is becoming a scarce resource in many parts of the world and needs to be used as efficiently as possible. Saturas claims “80% of farmers irrigate their trees without any scientifically-based information. This causes water waste, affects the quality and quantity of the fruit, and reduces profitability.”

Saturas, a Trendlines Group’s Agrifood incubator company, recently closed its series B totaling $3m. The value proposition of the company is enticing. Saturas claims precision irrigation technology can lead to increased yields, minimize risk, save water, reduce water costs, lower contaminations, produce healthier trees, and enable more planted areas. The company is looking to use its funding to expand into new strategic markets in addition to developing relationships with distributions, and irrigations research labs.

Our Takeaway:

A 2018 study by the EPA estimates that the agriculture industry accounts for 10% of greenhouse gas emissions in the United States. This does not consider the other environmental impacts of the industry like water conservation. Flexible first movers in the irrigation space will Have a tremendous advantage over their stagnant counterparts like sprinklers. Solutions should focus on;

The “Win-Win”: Cost savings, increased efficiencies, higher yields, etc. while also being environmentally friendly

Urgency

A hedge against environmental changes already in effect

Doodle

Being a sports fan and Wisconsin native, it has been hard to see all sports go on pause since the Bucks were in a perfect position to make a finals run. The NBA coming back is exciting and their execution is even more interesting. For those who are unaware of how they are restarting the season, only 22 of the 30 teams will be playing and the playoff field has been narrowed from 16 teams to 14 teams. There will be no fans in the seats and the only revenue will be coming from advertisements and television broadcasts. All the players and coaches will be staying in hotels on the Disneyland campus. There are 3 hotels that will house them, and the NBA determined which teams were living in each hotel based on current seeding. This is interesting to me because there could be some animosity in those hotels come playoff time. The best 8 teams will be under the same roof.

While this will inevitably change their routines, the NBA is trying to accommodate the players as much as possible. In these hotels, the players will have a player’s only lounge, pools, barbers, manicurists, pedicurists, video games, movie screenings, DJs, ping pong, and lawn games. That sounds like an incredible 5-star experience. I cannot imagine the players having too much complaining regarding the execution of restarting with all of those amenities. Take a look below to see the pictures of the courts that will house the NBA finals this year.

Learn Something

3 V’s

Average Daily Trading Volume

The average number of shares traded within a day in a given stock

https://www.investopedia.com/terms/a/averagedailytradingvolume.asp

Watch: Does volume stays current? Is capital flowing in or out of the market?

Volatility (VIX)

A real-time market index that represents the market's expectation of 30-day forward-looking volatility

Watch: Using VIX to approximate risk, fear, and stress in the market.

Valuations

The analytical process of determining the current (or projected) worth of an asset or a company

Watch: Traditional techniques are no longer relevant or we are in a bubble

NBA Returns

If you want to do a deeper dive on the NBA returning look at the resource we used below:

Continuous Improvement

Tell us how we are doing! We always appreciate feedback and want to do our best to connect with our readers.

Please take our survey:https://docs.google.com/forms/d/e/1FAIpQLScngneDBiiGoISePVr4irhxu9r01pB6U05D8N9DAeTEVCclRQ/viewform