eSports is a massive, rarely talked about industry on the rise. If you are unfamiliar, eSports is a digital tournament where professional gamers play competitively, usually for prize money in front of spectators. These spectators are either in person (pre-covid) or streaming from their home.

The origins of eSports can be traced back to 1972, but we do not care about the history. Where are we now?

eSports really started its climb in its natural habitat – the internet – in 2012. In 2012 there were 58 million independent frequent views globally. Coincidently, or not, in 2011 the video game streaming website “Twitch” (Now Owned by Amazon) was officially launched.

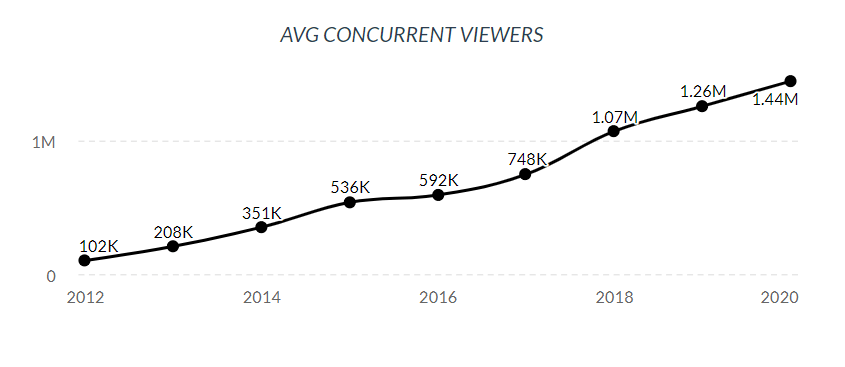

In 2012, Twitch reported 102K monthly active users and grew their viewership at a CAGR of 33% to 1.44M viewers in 2020. Why does this matter? Twitch was the pioneer of video game streaming; eSports has always been around, but Twitch helped pave the way to its current success story.

It is reported that the entire eSports market made over $1 billion in revenue in 2020. If you do not understand the economics of the eSports market let me break it down. Are you familiar with football, basketball, or baseball? eSports does the same thing they do to make money.

To be serious, it is all advertising and viewership. This market has become rich in viewership, especially since the pandemic. Their audience is 495 million viewers, and analysts expect the viewership to continue to grow to 646 million in 2023. This market could be thought of as the traditional sports market, each game is totally separate sport making the market rather fragmented.

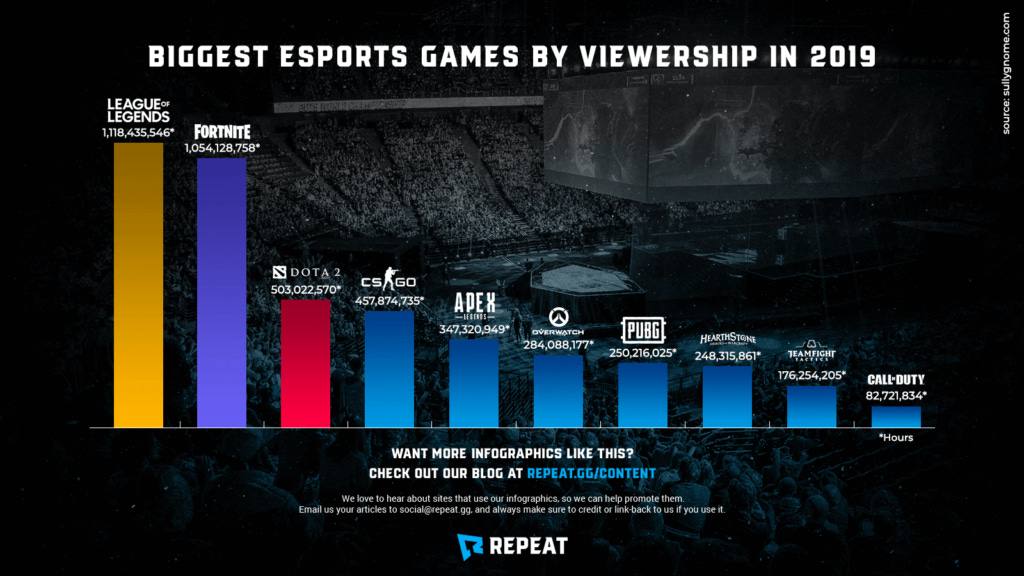

The 2019 infographic below is composed of total hours viewed. It is important to summarize the “hours viewed” as opposed to total views because unlike TV, advertisers pay for real viewership, not projected viewership as most sporting events do. The eSporting producers only make money when there are people watching the commercial. If there were 1 Million people watching 30 minutes before the ad and only 200K watching during the ad? They only get paid on those 200K viewers.

The largest game logged 1.1 Billion hours; this cumulative number of hours is equal to 46 million days. When comparing, it is still not on the same level as football, which logged a projected 500 million days. The entire eSports market in Q2 2020 logged 162 million hours, or 648 million days annualized.

This market is important because there is no sign of slowing in video game consumption, especially in our post-covid world. The largest demographics for eSport consumption is the 25-34 age bracket, 54% of the market. Companies could begin to allocate higher marketing spending towards this kind of content as the core viewers are growing with age and income. This only makes the eSport industry more appealing.

So how do you invest in eSports?

AMD: Has some of the best chips for PC gaming used by most professionals

Sea Limited: Owns the largest eSporting League in Asia (Asia is 54% of the entire eSport market), Partner of Tencent, Distributor of Popular Video Games

Activision: Owns one of the largest US eSporting leagues (MLG), and owns several popular eSporting games

EA Sports: Owns Popular eSport Games

Tencent Holdings: Owns Popular eSports Games