Investment Thesis

We believe Visa’s global payment infrastructure has established the company as a market leader in the industry. Visa’s network effect and toll booth fee structure creates reliable reoccurring revenue streams at multiple touchpoints in the payment processing value chain.

Company Description

Visa engages in the provision of payment services by facilitating global commerce throughout the world for many stakeholders along the value chain including consumers, businesses, and governments.

Qualitative

Overview

Sector: Technology

Industry: Internet Security & Transaction Services

Competitors: MA, FIS, AMEX, UEPS

Market

Traditional Partnerships: banks, financial institutions, and merchants

Emerging Players: digital banks, wallets, and fintechs

Business Model: Toll Booth

Visa owns the infrastructure necessary to conduct a transaction between two parties and earns fees regardless of the payment type (credit, debit, or mobile).

Moat: Global electronic payment infrastructure.

Visa has access to 99% of bank accounts in 88 countries (including the top 50 largest markets), 13 of the top 20 global credit cards, and almost 16,000 financial institution partners.

Visa benefits from the network effect; the more users it has, the more attractive it becomes to potential customers.

X-Factor: Own (keep) the infrastructure.

Visa is the world leader in digital payments. Their infrastructure remains crucial to the companies market surperiority.

New products should build trust, expand accessibility, and increase ease of use to drive users to the payment network.

Business Drivers

Cash Cow: Data Processing

$10.3B in revenue

Earned for authorization, clearing, settlement, value-add services, network access, maintenance, and support services that facilitate transaction and information processing.

Growth Opportunities

Digital Payments

Digital payments surpassed cash payments on a global basis just a couple of years ago.

Visa bought Plaid in January 2019 in an effort to stay on the cutting edge of future fintech infrastructure including P2P, G2G, B2C, and B2B payments.

Visa is also introducing new products like “scan to pay” which has grown in popularity among merchants for its lower fee structure

Emerging Markets

Visa has the opportunity to build the payment infrastructure in countries with accelerating mobile usage and internet connectivity

Privacy & Digital Security

Last year Visa’s AI-powered risk scoring engine helped financial institutions prevent $25billion in fraud.

Expanded Product Suite

Chip technology, EMV 3-D security, Visa Token Service

Value Add Services

Merchant & Acquirer Solutions / Consulting & Analytics

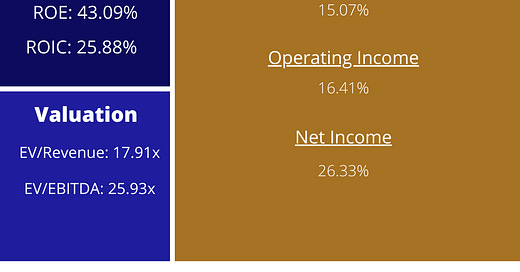

Quantitative

Risks

COVID-19: Lower payment volume and fee collection from cross-border (high fee) transactions.

Visa Competes against all forms of payments.

Some governments have blocked Visa from operating in the country in an effort to grow the industry domestically.

More than half of Visa’s revenues are generated outside of the U.S. and values can fluctuate based on the strength of the U.S. Dollar.

Learn Something

Definition: The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners